Table of Content

I recommend Mission Fed to anyone looking for a bank that feels like your neighbor and treat you like family. We are owned and governed by our members and lead with a people-over-profits philosophy. Our members and the communities we serve are the heart of everything we do. We’re a member-owned, not-for-profit financial cooperative dedicated to serving your financial needs. If you are a first-time homebuyer, we can provide helpful information, including programs that you can benefit from, mistakes to avoid, and items to consider when you begin your home buying journey.

We offer a number of benefits and services to make banking easier and help you stay organized. Our system can provide customized email or text message notices to help you keep track of your account activity. You can also change your contact information, stop payment on checks, order new checks or change account information with our self-service options. For the environmentally conscious or those with cluttered desks, paperless banking saves paper and keeps all your information in one place. Sign up for Mission Rewards on your Mission Fed Credit Card to accumulate points and enjoy the benefits, and manage your account from our Online Banking system. We can even help you track your spending to keep on top of your budget and savings goals.

Home Equity Loans: 2nd Lien Fixed Rate

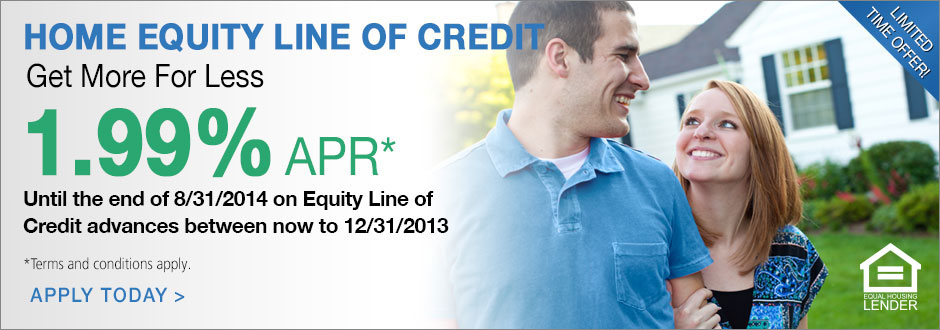

Homeownership can seem like a never-ending journey. Let us help you navigate everything from buying and selling a home to understanding mortgage products and refinancing. Home equity is a valuable asset that can be used to reach a variety of financial goals. A+FCU helps to make sure you understand the ins and outs of home equity loans and compare your options. The federal agency that administers our compliance with these federal laws is the Federal Trade Commission, Equal Credit Opportunity, Washington, DC, 20580. A Certificate allows you to grow your savings while enjoying the safety and security of your investment.

You can apply online or at your local branch with the help of one of our knowledgeable team members. APRs assume a minimum credit score of at least 720, and a combined LTV of less than 90% for a home equity loan and a combined LTV of less than 70% for a HELOC. New Subordinate Loan InformationEnter new subordinate loan information. Needs to review the security of your connection before proceeding. +Rates are based on an evaluation of credit history, so your rate may differ. You may also attach documents to a secure message while logged in to your account using the Support feature.

Mission Fed - Loans, Credit Cards and More for San Diego

We don't control the content of our partner sites. Please review their Privacy Policy as it may differ from our Privacy Policy. We hope you found the information you were looking for from Mission City FCU. Before you decide to purchase or refinance a home, make sure your new payment will fit in your budget. We’ve provided a wide range of calculators for you to use to determine what your payment could be.

For current rates and payment examples, please refer to our Daily Mortgage Rates page. Monthly payments do not include property taxes or insurance, your payment will be higher. APRs assume the purchase of a single family, primary residence in California, a credit score of at least 740, and a combined LTV of 60% or less. For borrowers with less than a 20% down payment, mortgage insurance is required. Maximum loan amounts range from $647,200 to $3,000,000, depending on loan program.

LiveSmart Insurance Services, LLC

Rates, terms, and conditions subject to change without notice. Click here to learn about the options available to credit union members through TruStage®. The insurance offered is not a deposit and is not federally insured or guaranteed by your credit union.

Send Money Easily with Zelle® It's easy, fast and secure to send and receive money with your friends and family using Zelle. You are leaving MissionFed.com to a website that Mission Fed Credit Union does not control. We do not endorse and are not responsible for the content, privacy policy, or security policy of other websites. We encourage you to review their security and privacy policies. Insurance products are offered by LiveSmart Insurance Services, LLC a subsidiary of Mission Federal Services, LLC. Mission Federal Services, LLC is a wholly owned affiliate of Mission Federal Credit Union.

We've streamlined and updated the entire mortgage process to bring you a faster, more technologically advanced way to finance your home. We're pleased to be helping you with your first home. The more you know about the home buying process, the more confident you will be in making the important decisions that will shape your home ownership experience. In 1982, my mom, Donna, was working for San Marcos School District as a bus driver and opened her Mission Fed account. She has remained with Mission Fed for 40 years because she trusts the team will take care of her like family. I opened my first Mission Fed account when I graduated from college and bought my very first new car through Mission Fed.

Knowing your choices gives you the power to make good decisions. Throughout the Mortgage Center you'll find valuable information you may use when buying or refinancing your home. Our new Special Rate Savings account allows you to earn more on savings while having the flexibility to access funds when you need them. Gathering important documents before you apply for your Home Loan will help make the process quick and easy. Mission Fed makes applying for a Home Loan easy.

Insurance Products are not insured by NCUA or any Federal Government Agency; are not a deposit of, or guaranteed by the Credit Union or any Credit Union Affiliate; and may lose value. Mission Fed has partnered with HomeAdvantage to make buying or selling a home easy for you. You’ll be excited to learn you can earn cash rewards equal to 20% of your network agent’s commission. There are other benefits as well, including looking for your home online from the convenience of your sofa, and working with a preferred Real Estate agent from our local network. Get more details and see the numerous ways you can save time and money with HomeAdvantage and a Mission Fed home loan.

We encourage our members to enroll inonline bankingto manage your accounts, make loan payments, pay bills, and more at your own convenience. This is the safest and easiest way to access your money 24 hours a day. Click "Register" to enroll and activate your online banking profile. To ensure your enrollment is processed smoothly, please make sure your information is correct with the Credit Union. We offer a variety of home loan options from refinancing to construction with competitive rates and features.

To keep you from having to do all the math, we’ve provided rates & calculators for all kinds of situations. Your loan should be, too.We've been helping members purchase the homes of their dreams since 1959. Privacy and security policies of the site may differ from those of Gesa Credit Union. You are being redirected to a site that is not operated by Gesa Credit Union. Gesa is not responsible for the content of the site, nor does Gesa represent the site or the Gesa member if the member decides to act upon or enter into a transaction with the site.

No comments:

Post a Comment